To meet changing customer requirements and growing expectations, contact centers must be proactive and continuously improve their operational performance. However, shrinking budgets and other scarce resources make this task difficult.

One of the arrows in the contact center quiver is benchmarking: the process of improving performance by identifying, understanding, and adapting leading practices found both within and outside the organization. In the current environment of conflicting pressures—cost containment and growing customer demands—benchmarking can be the right tool for this difficult job.

Initial Considerations

There are two types of benchmarking, each of which serves a different purpose.

Performance, or quantitative, benchmarks are used to compare the results achieved with a given product or service against those offered by other similar companies. The outcome generally provides a comparative ranking and is often used to highlight performance areas that need further study and improvement. The companies selected for quantitative comparison are usually from the same sector, by either industry or functional group. Process, or qualitative, benchmarks are used to improve specific processes and operations within the business. Well-managed companies don’t use benchmarks simply to set targets. Instead, they look beyond the quantitative data to understand the processes, tools, and methods that leading companies use to achieve superior results.

For best results, both performance and process benchmarking should be used together. Think of them as complements rather than alternatives.

Deciding Against Whom to Benchmark

The standard of comparison can be external, internal, or preferably both.

There are three sources of external measures:

Benchmarking against pools or surveys of other companies.

Benchmarking against individual companies.

Benchmarking against customers (expectations).

For the most part, benchmarking against a pool or survey is the simplest way to conduct an external quantitative study. This type of benchmarking is usually sponsored by an industry or professional organization. Representatives of participating companies complete a survey or questionnaire and receive reports in return, perhaps for a fee, showing the relative performance rankings among the companies.

Companies seeking qualitative analyses will work with one company or a small group of other companies. Every company has unique processes, but some core processes and operations are common across industries. For example, almost all companies have procurement and accounts payable processes, and leading practices from one industry can be employed in others.

The third approach, benchmarking against your customers’ expectations, helps uncover disconnects in customer satisfaction. You may think your contact center is doing well, but benchmarking can point out frequent customer complaints that you’ve been overlooking. Customer benchmarking is especially important for companies that provide services to other businesses and in industries where the cost of losing a customer is substantial.

Examples include third-party logistics providers, contract manufacturers, and shippers that supply product to retail stores or distributors.

Internal benchmarking involves looking inside your organization, rather than at other companies or industries, to identify leading practices that can be leveraged across the organization. Any company with multiple business units, divisions, or locations can use internal benchmarking. Even small companies with a single location can internally benchmark by comparing how individual employees approach similar tasks.

One advantage of internal benchmarking is that it’s easier and less expensive to implement. It also creates a culture of continuous improvement, in part by spurring internal competition. However, a potential drawback of internal benchmarking is that it may not provide comparison against true leading practice standards. Using multiple sources—both internal and external—to measure performance will enable you to better understand your organization’s processes, your customers’ opinions, and how well you stack up against competitors.

Barriers to Effective Benchmarking

A major stumbling block for companies as they start to benchmark is obtaining reliable statistics on their own contact center operations. Often the information must be painstakingly assembled from disparate systems. Even when the statistics can be gathered, it may be difficult to align them with industrywide measures to perform apples-to-apples comparisons.

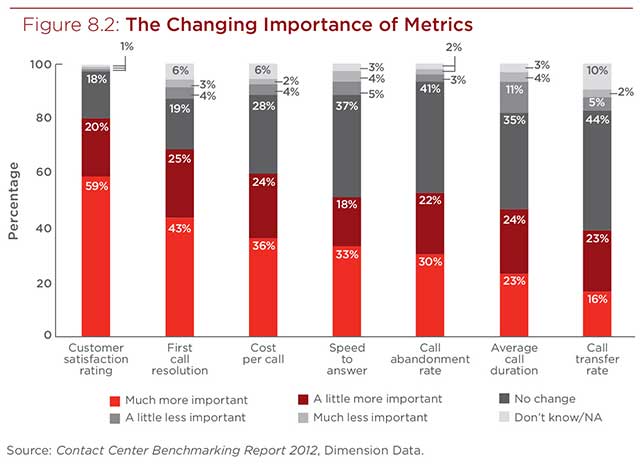

Companies often make the mistake of measuring for the sake of measurement, and in the process they calibrate everything. As many as 150 metrics can be measured in a contact center. But too many metrics can make it difficult, if not impossible, to develop meaningful conclusions from the mountain of data you collect. As an alternative, consider identifying 10 key performance indicators. Tie those indicators back to your strategy, operations, people, processes, and technology to improve competitiveness, customer service, and efficiency.

Another common pitfall is when the performance indicator itself becomes the goal. If the company you’re benchmarking against achieves a low rate of customer-abandoned calls or high customer satisfaction, that flashy measure may become the end goal, regardless of what dysfunctional or inefficient processes may underpin it. In contrast, companies that benchmark successfully will try to find out why processes work well rather than just their end results. For example, if a contact center is handling something potentially complicated like insurance claims, it doesn’t make sense to set a target talk time of less than a minute for agent interactions. So always look at the qualitative context, not just the quantitative results, in order to choose the most meaningful benchmarks.

Making good use of benchmarking results is the next challenge. Appropriate, insightful interpretation of the results is essential to identifying which shortcomings should be the ones you invest time and energy into fixing.

Once you’ve identified the opportunities, the real work of putting them into action begins. This can’t be emphasized enough: Benchmarking alone doesn’t improve performance. You have to take action based on the benchmarking results. It’s critical to understand where inefficiencies and performance gaps are occurring within your organization and then identify and implement changes to address the poor performance. And always keep unintended consequences in mind—an attempt to improve performance in one area can drag down other areas.

Implementing a benchmarking program and acting on its results will help equip your organization to improve continuously. Focus on developing a strategy to implement leading practices and on making the process changes needed to drive improved performance.

New Metrics for CEM

Even with the changes in today’s marketplace, the traditional contact center metrics of customer satisfaction scores, first call resolution, and service analytics can still act as your measurement foundation.

Customer satisfaction scores continue to reveal a lot about how your customers perceive your organization and whether they’d like to continue doing business with you. Avaya’s Consumer Preference Study found that a great customer experience not only helps maintain your current business, but also motivates 70 percent of customers to spend more money (Avaya, 2011).

Both first call resolution and service attempt analytics reveal the efficiency of your contact center and the impact on customer experience. Identifying the frequency and duration of your customer calls can help you target areas for quality improvements. We found that 36 percent of customers will consider defecting after only two to three attempts to resolve their issue! Staying on top of these traditional metrics will allow you to make better, more customer-centric decisions.

Because of how communications has evolved, there are now a number of new channels you must monitor for customer experience effectiveness:

Measuring your social media interactions has become a critical priority due to the prevalence of social media in today’s marketplace. Listening to the market and engaging in the right conversations can help you spot issues and opportunities as they arise, perhaps even before anyone contacts your organization. Avaya has found that 50 percent of customers are more likely to buy if they’re already engaged with an organization through social media.

The integration of social media into the contact center has only just started. The metrics are still being defined. However, metrics that companies are beginning to monitor include mentions of a company and its products or services on social networking sites; responses to blogs and Twitter posts regarding the company; and use of tweets to communicate directly with the contact center.

Speech analytics introduces the ability to dissect the content of your recorded calls and meetings. These tools provide companies with deeper insights on the quality of their past interactions in order to improve service effectiveness for greater customer satisfaction.

The Power of Applying Benchmarking Results

After it added 14,000 customers virtually overnight, a southern California waste management company’s contact center began experiencing significantly higher call volume. The company believed it could use existing call center technology more effectively and improve several key performance indicators such as call abandon rate and the average speed to answer calls.

The company conducted a benchmarking and performance audit on its existing contact center. The resulting report addressed effective management practices, operational and technology changes focused on customer satisfaction and operational efficiency, and industry-leading performance objectives and results for comparable service industry contact centers. After implementing the recommended changes, the waste management company achieved significant improvements, including these:

The average speed to answer calls was cut by nine seconds.

Customer satisfaction ratings improved by 14 percent.

Call abandon rates declined by 16 percent.